One of the biggest fears people have when they’re approaching or entering their retirement years is: What if I run out of money?

You’ve worked hard your whole life, you’ve saved, you’ve invested, but with market volatility, inflation, and an increasing life expectancy thanks to medical advancements, retirement can be challenging. Nowadays, it’s more difficult than ever before to properly predict how long your retirement nest egg will truly last. This is where annuities can help ease your worries as you enter retirement. Here at The Lambert Agency, we assist retirees and those nearing retirement age utilize annuities as an exceptionally powerful tool to help protect against outliving retirement savings.

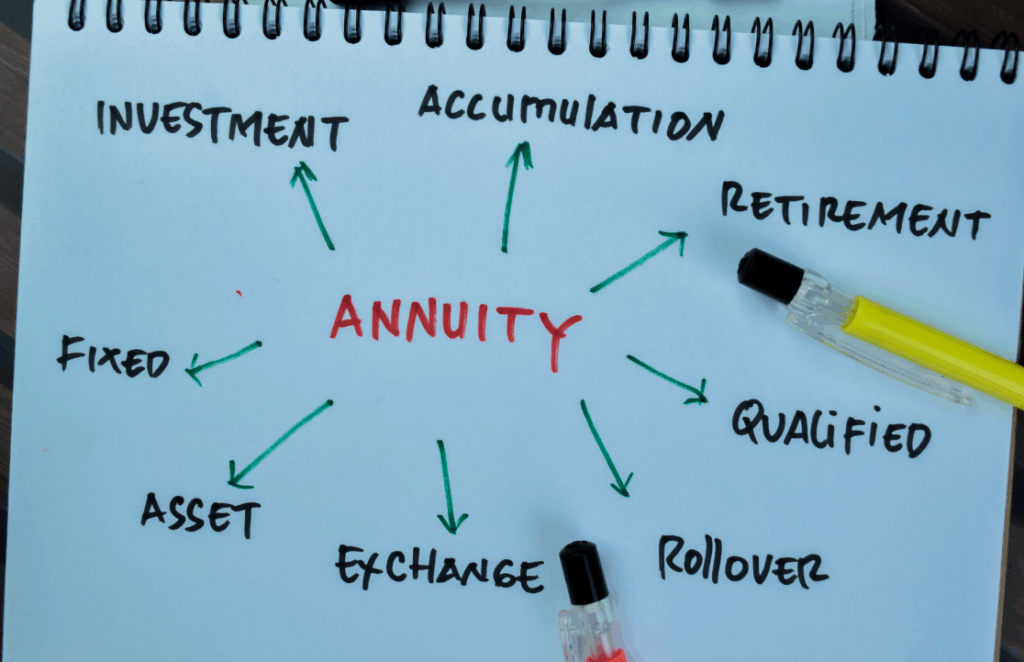

What Is an Annuity?

Essentially, an annuity is a financial product which is offered by insurance companies to provide recipients with a guaranteed stream of income, oftentimes for the duration of their life. Think of annuities as creating your own personal pension plan. You’ll begin by paying a lump sum or series of payments towards your annuity, then the annuity pays you a predictable income over the years according to your terms and risk tolerance.

There are multiple types of annuities to choose from, including:

- Fixed Annuities – Fixed annuities provide steady, guaranteed interest growth and predictable payments, so you can rest assured you’re going to continue receiving income well into your retirement years.

- Indexed Annuities – Indexed annuities are linked to a market index, such as the S&P 500, with the benefit of offering downside protection over time.

- Immediate Annuities – Immediate annuities convert your lump sum contributions into income immediately.

- Deferred Income Annuities – Deferred income annuities will start your payment schedule at a predetermined future date. This type of annuity is oftentimes used for longevity focused planning.

Here at The Lambert Agency, we walk you through each option and explain the positives and negatives, to help you best determine which annuity fits your overall retirement goals.

How Annuities Help You Avoid Outliving Your Money

- Lifetime Income

Annuities offer multiple payout options which typically last as long as you’re alive. This translates to offering you payments, even if you live beyond 100 years of age. The lifetime guarantee of continued payments is certainly one of the best features of annuities. - Protection From Market Volatility

If your primary savings vehicle is a 401(k) or IRA, a poor performing market may greatly affect your anticipated income. When you work with The Lambert Agency, we help determine which annuity is the best choice for guaranteed income which is not subject to the ups and downs and swinging volatility often associated with 401(k)s or IRAs tied to market performance. - Predictable Budgeting

When you know how much money you’re receiving on a regular basis through fixed income streams, it helps make life easier when it comes to budgeting and planning your finances. Everyday expenses and bills such as housing, healthcare, utilities, groceries, etc… are easier to manage without having to worry about not having enough money. - Customizable Options

There are many customizable options you can incorporate into your annuities. Some of these options consist of everything from inflation-adjusted features and joint payouts for couples. Here at The Lambert Agency, we enjoy assisting our clients with designing their perfect annuity for their lifestyle.

Who Should Consider an Annuity?

Properly selected annuities can be a great fit for:

- Retirees who don’t have a pension and are seeking out a guaranteed income

- Individuals or couples who are worried about fluctuating market risk in their retirement years

- Couples who want a lifetime income stream to continue providing for the surviving spouse, ensuring financial security and stability

- Anyone who is entering retirement age and values financial peace of mind while not wanting to stress about outliving their savings

Common Concerns About Annuities

“Are annuities expensive?”

Some forms of annuities may carry higher fees than others, yet many modern annuities are quite cost-effective. The Lambert Agency assists you with comparing and contrasting annuities to best determine the annuity which will simultaneously maximize investment value while reducing unnecessary expenses.

“What if I want flexibility with my annuity?”

Specific annuities allow withdrawals, income riders, or lump-sum access, depending on the specific terms and conditions. The best choice you can make is working with a knowledgeable insurance agency such as The Lambert Agency, to best align the right annuity with your lifestyle.

“Do annuities replace my other retirement accounts?”

No, they do not. Annuities are specifically designed to complement your other retirement accounts, such as 401(k)s, IRAs, and various brokerage accounts through the addition of a guaranteed income.

How The Lambert Agency Helps

When you choose to work with The Lambert Agency, you’re going to find we specialize in retirement strategies which balance both income protection and income growth. When it comes down to annuities, we help:

- Compare and contrast the top-rated annuity carriers and products

- Properly illustrate income scenarios based on your age, health, and overall retirement goals

- Fully explain features such as income riders, death benefits, and inflationary protection in easy to understand language

- Provide ongoing annuity plan reviews so your annuity is continuously aligned with your retirement plans

Contact The Lambert Agency Today

When it comes to actually entering your retirement years, outliving your savings should not be a worry. With the right annuity product and strategy, you’re able to fully enjoy your retirement knowing you have a guaranteed stream of income for the remainder of your life. When you choose to work with The Lambert Agency, we’ll assist you with the various annuity options, select the right carrier, and truly design a proper solution which provides financial security paired with peace of mind.